http://www.swiaconferences.com/video-July--Eagle%20Ford%20Oil%20Gas.html

We are early in the play and lease bonuses will be going up substantially from the $10,000 per net acre we are seeing today. The dam has burst.

This editor has confirmed that a $12,500 per net acre lease bonus offer was made on a 80 acre tract in Gonzales County near where a well is currently being drilled. Lease bonuses and royalty are highly negotiable now.

Reasons the Eagle Ford is highly commercial and more valuable than other shale plays

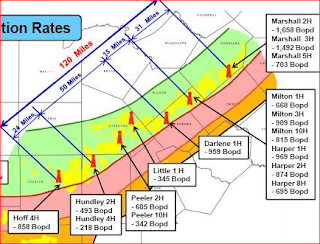

- In the best parts of the shale that produces oil, the wells are producing at rates of up to 1,000 barrels of oil per day (BOPD), and the estimated reserves are 500,000 barrels of oil equivalents (oil equivalents factor in the casinghead gas along with the oil produced) per well. In the best parts of the shale that produce natural gas, the wells are producing at rates of up to 5 million cubic feet of gas per day (MMCFGPD), and the estimated reserves are 6 billion cubic feet (BCF) of gas equivalents (gas equivalents factor in the condensate along gas produced) per well.

- The Eagle Ford shale appears attractive because of several additional factors:

- It appears to produce much more oil than the other shale fields

- It has a much higher carbonate:shale percentage, thus making it more brittle and “fracable”.

The cost to frac Eagle Ford wells is substantially less than other shale plays. In the thicker parts of the trend in DeWitt County, operators are able to drill upper and lower laterals that produces roughly double the estimated ultimate recovery of oil.

www.p2energysolutions.com/newsroom/tobin-trends has a lot of useful information on their website. The graphics below are examples of the information available from them.