Minerals No Longer Available

Accepting Offers For Surface Use Only

Accepting Offers For Surface Use Only

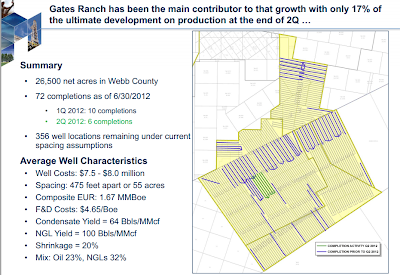

High-Grade 45-50 degree API Volatile Oil w/88% Liquids

DeWitt County In The Heart Of The Best Acreage

contact owner Mike Green at 361-648-5800 email libertadormg@gmail.com

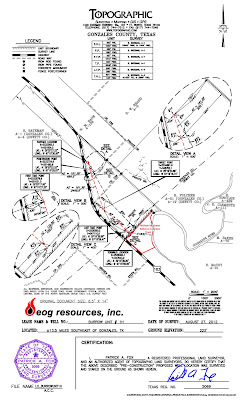

This property is located on a major highway, US 183, and is directly across the road from the EOG Meyer Unit. Tract has over 1,600 ft of US 183 highway frontage, approximately 1/2 mile Guadalupe River frontage, it is very close to the Enterprise pipeline, and comprises the only substantial acreage in the area that does not flood for approximately a mile in all directions. This land quite simply has multiple superior strategic advantages for developing the Eagle Ford in the Steen Plain area of the Eagle Ford oil and NGL windows. All adjacent tracts are leased to EOG Resources. Notable is the fact that very little land in the immediate area did not flood in 1998 with the notable exception of a good portion of this property. All depths and horizons are available, including the Pearsall.

CONTACT OWNER MIKE GREEN 361 648 5800

High Grade Area

Irregular shape should allow for more lateral's

High Ground elevation in large flood plain. Potential drilling site above historic flood level of 1998

Major highway frontage on US 183

Meyer Unit across highway and Burrow B Unit on property line

Area is being rapidly developed with infill drilling

High ground on US 183