Helpful oil and gas leasing and farmout agreement information for Eagle Ford Shale landowners in the DeWitt and Gonzales County area. PROUDLY A LANDOWNER ADVOCACY BLOG: the only landowner advocacy blog on the internet. The Eagle Ford provoketh thieves sooner than gold.

Friday, March 1, 2013

ON VACATION

My apologies to those of you who have been wondering what happened to my Eagle Ford blog. Well, long story short, the story is getting a little long in the tooth and so many others are covering what is going on that I have begun to feel a little superfluous chiming in. I'm very proud to have been the first to recognize the true value of the Eagle Ford and I did my level best to let all landowners know what was going to happen. Now I am leased, perhaps the last to do so, and there is far less need for my commentary. I am trying to think how I can re-brand this blog to serve landowners as I have been doing for so long now. I will keep you posted, so check back and see what I have in store. Thanks for all your past support. This blog has received several hundred thousand page views and is ranked highest of all Eagle Ford blogs on Google search. You guys have been listening to what I have been preaching. My hope for each of you is that you attain the success that I have by being armed with the information you need to know.

Wednesday, October 31, 2012

Minerals No Longer Available

Accepting Offers For Surface Use Only

Accepting Offers For Surface Use Only

High-Grade 45-50 degree API Volatile Oil w/88% Liquids

DeWitt County In The Heart Of The Best Acreage

contact owner Mike Green at 361-648-5800 email libertadormg@gmail.com

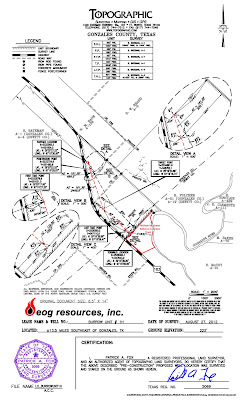

This property is located on a major highway, US 183, and is directly across the road from the EOG Meyer Unit. Tract has over 1,600 ft of US 183 highway frontage, approximately 1/2 mile Guadalupe River frontage, it is very close to the Enterprise pipeline, and comprises the only substantial acreage in the area that does not flood for approximately a mile in all directions. This land quite simply has multiple superior strategic advantages for developing the Eagle Ford in the Steen Plain area of the Eagle Ford oil and NGL windows. All adjacent tracts are leased to EOG Resources. Notable is the fact that very little land in the immediate area did not flood in 1998 with the notable exception of a good portion of this property. All depths and horizons are available, including the Pearsall.

CONTACT OWNER MIKE GREEN 361 648 5800

High Grade Area

Irregular shape should allow for more lateral's

High Ground elevation in large flood plain. Potential drilling site above historic flood level of 1998

Major highway frontage on US 183

Meyer Unit across highway and Burrow B Unit on property line

Area is being rapidly developed with infill drilling

High ground on US 183

Sunday, October 28, 2012

At DUG Eagle Ford Rosetta Resources Makes Bold Claims

Friday, October 19, 2012

Marathon High-Grading Eagle Ford Acreage

Marathon High-Grading Eagle Ford Acreage

The recent decision by Marathon to sell-off approximately 97,000 acres of their less economic dry gas and marginal black oil window Eagle Ford acreage in order to focus and concentrate on drilling and developing their over pressure volatile oil window acreage is roundly seen by analyst's as a net positive for the company. There has lately been a virtual stampede among operators to sell off non-core assets. Shedding their less economic acreage in favor of holding and fast-track developing their over pressure volatile oil window has become the du jour operator business model to follow of late. This sale will further enhance and validate the wisdom of last year's purchase by Marathon of an approximately 65% working interest in a large swath of EFS acreage from Hilcorp for $25,000 per acre. At the time last year Eagle Ford naysayers and those of little faith of the extreme economics of the play blustered profusely how foolish the $25,000 per acre price paid was. If as expected, Marathon successfully flips this less valuable acreage for the average price it paid last year of $25,000 per acre it will be seen by investors as smart business move.

A chorus of crude oil experts at the DUG Eagle Ford Conference recently joined in singing the praises of the Eagle Ford by proclaiming it's as good or better than anything found in the Middle East. The light sweet volatile oil window is just awesomely economic beyond belief. As operators pivot into oil factory mode and the extreme economics are better understood there will be deals for many, many multiples of the highest prices paid per acre to date. Publicly we know that Aurora Oil & Gas paid over $100,000 per acre for approximately 70% working interest in Sugarkane acreage in Karnes County a few months back. Expect private deals in the future to shatter this once thought lofty price. The show has just begun, Eagle Ford is the wonder of the oil industry today.

Tuesday, September 18, 2012

Valuing Eagle Ford Acreage

Valuing Eagle Ford Oil and Gas Assets

What is the value of the oil under your land in the Eagle Ford? It turns out that it’s not that difficult to learn the answer to that question by doing a little online research and putting that knowledge to work. With the enormous values being paid today between operators for undeveloped acreage in the Eagle Ford it’s the duty of us landowners to understand what we own. To do otherwise is dereliction. I see it as our sacred duty to protect our families by making them aware and passing on important information regarding the value of our land. Whether leased or not, you can get a better understanding of what you own by starting with the articles I have hyperlinked below.

Valuing Oil and Gas Assets In The Courtroom

VALUING PUD RESERVES: A PRACTICAL APPLICATION OF REAL OPTION TECHNIQUES

Try to become familiar with the different types of oil and gas assets by learning the following key definitions.

Prospect. A specific geographic area which, based on supporting geological, geophysical or other data and also preliminary economic analysis using reasonably anticipated prices and costs, is deemed to have potential for the discovery of commercial hydrocarbons.

Proved developed reserves (PDP). Reserves that can be expected to be recovered through existing wells with existing equipment and operating methods.

Proved reserves. The estimated quantities of oil, natural gas and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions.

Proved undeveloped reserves. (PUD). Reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

Wednesday, August 29, 2012

Guadalupe-Blanco River Trust

By granting a bequest of a conservation easement to Guadalupr-Blanco River Trust landowners can ensure that their property will be managed according to their wishes well beyond his or her lifetime. A conservation easement permanently limits a property's uses in order to limit development and ensure that the property is reserved for farming, grazing land, wildlife habitat or cultural values. Landowners can stipulate no oil and gas development. Tax incentives may be available to landowners. It's worth giving a serious thought.

Friday, August 24, 2012

DUG Eagle Ford

Last year I had the incredible good fortune to attend the DUG Eagle Ford conference in San Antonio and I heartily endorse, recommend and encourage all landowners who can to attend the conference this year. The direct benefits you will receive is a crash course education about what is going on in the Eagle Ford and Pearsall Shale. The speakers are highly regarded industry leaders that give you not only a review of where we are in the play but also an idea where Eagle Ford is heading. The exhibitor hall is immense, representing virtually all aspects of drilling and production technology and you get the opportunity to visit with them. The $895 investment you make to attend is a very small price to pay for the Eagle Ford education you will receive. If you own a Eagle Ford mineral interest you own something worth millions of dollars and you owe it to yourself and your family to attend DUG Eagle Ford.

Thousands have already registered;

Shouldn't your team get the same advantage?

Don't miss the world's biggest Eagle Ford conference Petroleum producers, midstream operators, finance and service professionals are converging in San Antonio this October for the 4th annual DUG Eagle Ford conference and exhibition. Shouldn’t you and your team be there to share the intelligence and make new business connections?An unparalleled slate of industry leaders is presenting and nearly 350 exhibitors are displaying their technologies. The biggest players on the scene, both upstream and midstream, will be attending. Once again, this event is the world’s largest Eagle Ford conference for the same reasons: It's the single best place to learn "what's next" for one of the most exciting regions in today's oil & gas business.

Featured speakers include: View full speaker line-up

EVP and COO Marathon Oil Corp. |  President and COO Pioneer Natural Resources |  President Swift Energy |

Speakers in the midstream program track — new for 2012 — will detail their plans for adding takeaway and treatment capacity. And one registration gives you access to both program tracks. Together, you get a full-spectrum perspective on where the opportunities lie ahead.

Go online to check the agenda and register today. Interested in bringing your entire team? Register 4 or more and receive $100 off each registration – just click the link when you register online.

Thursday, August 23, 2012

Drilling For Oil In The Unconventional Eagle Ford Shale

Drilling for crude oil in the

unconventional Eagle Ford shale is very much still in it's infancy. We are in the very early innings. The Eagle Ford has been know to be the

source for conventional natural gas and crude oil reserves in the

area for decades. Technology is improving at a very rapid pace and

horizontal drilling techniques continue to improve exponentially. Down spacing is occurring at 40 acres per well. EURs are going up substantially. Operators have rushed in to lease the best acreage in the six largest

shale basins that comprise 57 million acres. It's going to take a

very, very long time to develop all that acreage, perhaps a century

experts are saying.

Success in drilling in the Barnett,

Haynesville and Marcellus has caused the gas market to collapse.

Operators all want to drill on good oil prospects today like the

Eagle Ford volatile oil window. The oil window is where all the

action is today and that's where operators are allocating all of

their capital.

Little noticed in all that is going on

in the Eagle Ford is the way that it is shaping the future for the

petrochemical industry. Many large refineries and chemical plants are

being planned and announced for the Texas Gulf Coast. Pipelines are going in everywhere

along the entire length of the Eagle Ford. More pipelines are being

announced monthly.

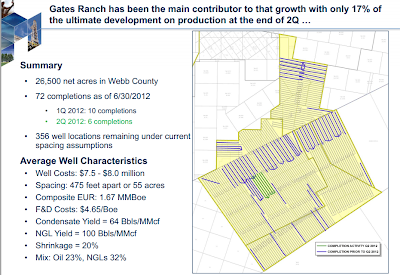

The long and short of the Eagle Ford is that all liquids window acreage is extremely valuable. Mineral interest to all depths and horizons is incredibly valuable. Rosetta Resources claims EURs of 1.67 Million BOE per well at 55 acre spacing. At $100 oil the 1.67 million BOE per

well translates to $167,000,000 per 55 acres. If you owned 55 acres

and you receive 25% royalty that would amount to $41,750,000 due you

over the life of the well. With other horizons like the Austin Chalk,

Pearsall, Olmos and Buda you quickly see why Eagle Ford footprint

acreage is selling for well over $100,000 per acre.

Friday, August 10, 2012

Monster Wells Being Drilled Near Hochheim

Eagle Ford Hochheim Area "Monster" Wells

The CEO of EOG Resources recently made official what everyone already knows, that the over-pressure volatile oil window around Hochheim is far and away the most productive area of the Eagle Ford. One of the Boothe wells came in recently at 4,820 barrels of oil per day with 972 barrels of NGLs and 4.5 million cubic feet of natural gas per day. The conversion of NGLs and gas makes the well officially produce 6,642 barrels of oill equivalent per day. Not bad.

Operators in the volatile oil window along Gonzales/DeWitt counties are actively pursing a down spacing drilling program. Rosetta Resources is even experimenting with 55 acre wells. The Rosetta presentation below shows what looks to me like their best case expectation of 5 million barrels of oil per 195 acres. I did the math and it came out to 25,641 boe per acre if I divided correctly.

http://files.shareholder.com/downloads/ROSE/2013999911x0x573592/B24DD1DC-EEF6-4D42-8EA2-55083FA958EA/ROSE_2012_IR_Presentation_-_RBC-_FINAL-2012_0531.pdf

Friday, August 3, 2012

EOG Resources announces

“Monster” Eagle Ford Wells

Oil

& Condensate daily IP near 6,000 barrels per day + 4.5 Mmcfd

natural gas

During

the 2Q conference call on 8/03/2012 CEO Mark Papa announced that EOG

had drilled 16 “monster” wells in the Eastern portion of the

Eagle Ford near Hochheim.

“In

the South Texas Eagle Ford, EOG drilled its best well to date. The

Boothe Unit #10H in Gonzales County began

initial production at 4,820 barrels of oil per day (Bopd) while an

offset well, the Boothe Unit #9H, had an initial production rate of

3,708 Bopd. The Boothe wells produced 972 and 527 barrels per day

(Bpd) of natural gas liquids (NGLs) and 4.5 and 2.4 million cubic

feet per day (MMcfd) of associated natural gas production,

respectively. “

Thursday, June 14, 2012

Aurora Oil & Gas bullies Eureka Energy stockholders

Aurora Oil & Gas has made a hostile offer to buy all outstanding shares of Eureka Energy. The story is a simple case of greed as old as the hills, whereby Aurora seeks to muscle Eureka stockholders out of their rightful ownership of Karnes County acreage in the prolific oil window of the Eagle Ford. The Aurora Oil & Gas "BULLY" offer is available for viewing at:

http://www.auroraoag.com.au/irm/Company/ShowPage.aspx/PDFs/2073-75620328/EKAAuroraOfferPeriodAutomaticallyExtended

As proclaimed in the masthead of this blog, THE EAGLE FORD PROVOKETH THIEVES SOONER THAN GOLD

http://www.auroraoag.com.au/irm/Company/ShowPage.aspx/PDFs/2073-75620328/EKAAuroraOfferPeriodAutomaticallyExtended

As proclaimed in the masthead of this blog, THE EAGLE FORD PROVOKETH THIEVES SOONER THAN GOLD

Sunday, May 20, 2012

Option Value of Eagle Ford Acreage

May 20, 2012

Understanding The Option Value Of Eagle Ford Oil Window Acreage: Why Leaseholds Are Worth Over $100,000 Per Acre

Oil company leaseholds create instant value. By way of example, in the Eagle Ford Shale Chesapeake Energy was a late leasing entrant with their first leases acquired in November of 2009 and reached 300,000 net acres by March 2010, and later reached 625,000 net acres by October 2010 having invested $1.4 billion in leaseholds. Chesapeake later sold 200,000 net acres for $2.2 billion, leaving 425,000 net acres and 2.3 billion Boe possible to Chesapeake at a negative cost of $800 million. By obtaining cheap leasehold interest it created $7-10 billion.

Leasing (in fact a lease is a sale) is simply a very cheap way for oil companies to buy oil options for future production. Leasehold investments are no longer risky in the traditional sense as conventional oil and gas drilling were in the past. Today, shale oil and gas represent a very cheap option on a know resource. Using Chesapeake Energy provided disclosure, at $2,200 per acre (CHK cost), a Chesapeake Energy Eagle Ford acre overlays a minimum 5,000 bbls of recoverable oil. That's an option cost of =$.40/barrel plus $15.00 to develop it. Meanwhile, a financial option on oil (a call) sells for =$20.00/bbl (at strip prices covering 2015-18). McClendon asks if it is smarter to buy a call option on a barrel of oil at $20/bbl where the strike price =$90/bbl for an all-in cost of $110/bbl, or is it smarter to pay $.40/bbl and a $15/bbl "strike" price for an all-in cost of $15.40/bbl?

Chesapeake Energy brags their developments costs is $10-15/bbl which is effectively the strike price of this option

The CEO of Chesapeake Energy Aubrey McClendon famously asked the question "where else in the world, in any industry, cay you buy an asset for $1-1.5 billion and have it become worth >$5 billion within one year? Nowhere!" In no other industry are sheep led so willingly to the slaughter. Hydraulic fracturing along with a plethora of other new drilling and completion technology has changed the face of the oil and gas industry.

The Estimated Ultimate Recovery of all Eagle Ford Shale wells continues to go up substantially through down spacing, making it impossible to predict with any certainty how much above $100,000 per acre we will see. One thing is certain though, we are very early in the game and recovery factors are being improved by leaps and bounds.

From Aubrey McClendon's mouth to your ears:

Saturday, April 7, 2012

Royalty Sellers Succumb to JG Wentworth Ad Tactics

Landowners who sell their royalty interest today are doing so at a deep discount to the future value of their Eagle Ford production. Some landowners never even received anything like fair value for leasing their land for drilling rights to begin with. Now again today they are being approached by predators in what amounts to a double whammy and they are being conned out of their royalty income, selling it for pennies on the dollar.

Subscribe to:

Posts (Atom)