H. L. Mencken

Company investor presentations are road maps that tell a story about where a company has been and where it is going. The internet abounds with Eagle Ford operator online investor presentations that are data rich and contain the blueprint as to what operators have planned and are executing in the Eagle Ford Shale. A case in point is the recent presentation by Chesapeake, which validates everything I have been blogging about for some time now. Their most recent presentation can be found at

and it is not only the Chesapeake model for Eagle Ford development, but it is the universal strategic blueprint model being used by all the operators in the Eagle Ford.

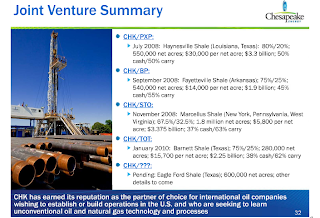

At the core of operator strategy is leasing acreage at below market prices and then taking that acreage and parlaying it into serious capital gains for themselves. Operators are flipping their valuable low cost lease acreage to others for fabulous fortunes at enormous price per acre markups. Chesapeake and all the other Eagle Ford operators are paying chump change for valuable acreage and then reselling that acreage at a tremendous profit.

All of the operators in the Eagle Ford have the same strategy, which is to lease acreage for peanuts and then flip and finance all their operations on the backs of the uninformed landowner.

Study the slides below and you will see how operators plan on exploiting landowners.

In 2 half of 2010 and 2011 Chesapeake will focus on recapturing significant portion of these new leasehold expenditures through joint ventures and asset monetizaitons

Within one year of acquisition, Chesapeake will sell a minority interest in a new play (Eagle Ford), recovering all or virtually all of the cost to acquire the leasehold in the Eagle Ford play and fund a significant portion of CHK's future drilling costs in the Eagle Ford play.

Very attractive rates of return

Relatively shallow formation results in lower drilling and completion costs

Value of liquids is 3x more valuable than gas on BTU basis which makes the actual production today equal to, or greater than the acreage in Haynesville and Barnett purchased at $30,000 per net acre

OPERATORS CAN ONLY EXECUTE THEIR LANDOWNER PREDATORY PLAN SO LONG AS LANDOWNER'S ARE IN THE DARK AND UNINFORMED. DON'T BE A VICTIM OF BIG OIL! STAND UP FOR YOUR RIGHTS! DEMAND FAIR COMPENSATION AND SUA TREATMENT. JUST SAY NO TO LOW BALL OFFERS.

THERE ARE NO DRY HOLES

EAGLE FORD SHALE COST HALF TO FRAC COMPARED TO HAYNESVILLE & BARNETT

SHALE ZONE IS THICKER ALLOWING FOR UPPER & LOWER COMPLEX MATRIX COMPLETION

EAGLE FORD SHALE, ESPECIALLY OIL WINDOW ACREAGE IS WORTH FAR MORE THAN THE $30,000 & 27 1/2% ROYALTY PAID IN HAYNESVILLE AND BARNETT

I used to think I was lucky getting a lease. I feel foolish now.

ReplyDelete