Eagle Ford Oil & Gas Lease Information DeWitt County

Helpful oil and gas leasing and farmout agreement information for Eagle Ford Shale landowners in the DeWitt and Gonzales County area. PROUDLY A LANDOWNER ADVOCACY BLOG: the only landowner advocacy blog on the internet. The Eagle Ford provoketh thieves sooner than gold.

Saturday, September 28, 2013

Congressman Blake Farenthold In The Tank With Big Oil

Congressman Blake Farenthold was elected to the House of Representatives to represent the people of South Texas. The unfortunate truth is that he has become a bought and paid for lap dog for Big Oil to the detriment of landowners, private property rights and the honest people of South Texas who mistakenly voted for him due to the false belief that he would be a conservative voice for the area. Weather he's a wolf in sheep's clothing or merely a bozo in Duckie Pajamas that work against landowner's and royalty owners interest, he has to be called out.

Monday, August 26, 2013

August 26, 2013

Engineering and site analysis studies continue to go forward on the entire 70+ acre tract. The addition of three phase electricity is scheduled for US 183 along our property line. All options are on the table and are actively being studied, analyzed and weighed. If you have a high quality project in mind or a need for top tier high quality commercial real estate in the Hochheim area with US 183 access, let us hear from you. The advantages of this tract are to numerous to list. This is truly a rare opportunity for land with live water and is out of the flood plain, high traffic count major US highway with advantages of easy access to highway. One of a kind property without peers.

Tuesday, August 6, 2013

August 6th, 2013

UPDATE:

I have been busy working with engineers, surveyors and doing market analysis and traffic surveys in regards to the best use of the 70.15 acres on US 183 and the Guadalupe River. As most of you are aware, US 183 is currently undergoing a major widening project along that stretch of highway due to the enormous amount of traffic the highway is currently experiencing. There is also 3 phase electric service coming down the highway in the very near future.

The area situation is dynamic and fluid. There are thousands of wells to be drilled in the immediate area as well as petrochemical facilities on the drawing board that may ultimately impact how my acreage is developed.

If you have and idea for some kind of joint venture, I invite your suggestions.

Mike Green

libertadormg@gmail.com

tel 361 648 5800

UPDATE:

I have been busy working with engineers, surveyors and doing market analysis and traffic surveys in regards to the best use of the 70.15 acres on US 183 and the Guadalupe River. As most of you are aware, US 183 is currently undergoing a major widening project along that stretch of highway due to the enormous amount of traffic the highway is currently experiencing. There is also 3 phase electric service coming down the highway in the very near future.

The area situation is dynamic and fluid. There are thousands of wells to be drilled in the immediate area as well as petrochemical facilities on the drawing board that may ultimately impact how my acreage is developed.

If you have and idea for some kind of joint venture, I invite your suggestions.

Mike Green

libertadormg@gmail.com

tel 361 648 5800

Thursday, June 20, 2013

I continue to analyze and evaluate different options that have presented themselves to date. A formal offer of land for sale will in all likelihood will not occur until complicated tax issues and development questions have been adequately assessed and addressed. While this exploration process continues we are open and willing to listen to legitimate development offers, ideas and suggestions as to the best use of the land. The fact that this tract has 1/2 mile of live water on the Guadalupe River, substantial US 183 highway frontage and electric service infrastructure in place makes it a premiere location for multiple development ideas.

Parcels of the 70.15 acre tract of land fronting on both US 183 and the Guadalupe River will soon be offered for sale. Check back here for details about property offerings very soon.

This map is the official FEMA flood plain designation. Most of the subject property coming up for sale is outside of the 100 year flood plain.

Live Water Property on the Guadalupe River with multiple buildable home sites are extremely rare to find in South Texas. This property has both home and recreational uses for boating, swimming, fishing, and scenic enjoyment. Owning a live water tract is the ultimate status symbol.

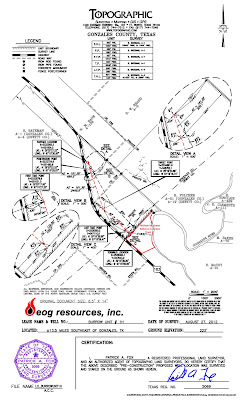

USGS topographic map

FEMA map

Parcels of the 70.15 acre tract of land fronting on both US 183 and the Guadalupe River will soon be offered for sale. Check back here for details about property offerings very soon.

This map is the official FEMA flood plain designation. Most of the subject property coming up for sale is outside of the 100 year flood plain.

Live Water Property on the Guadalupe River with multiple buildable home sites are extremely rare to find in South Texas. This property has both home and recreational uses for boating, swimming, fishing, and scenic enjoyment. Owning a live water tract is the ultimate status symbol.

USGS topographic map

FEMA map

USGS topographic map

The FEMA and USGS topo maps clearly show the vast majority of land in the Steen Plain is either in the floodway or the flood plain. There quite simply is precious little land in the area that is not subject to severe flooding.

Wednesday, May 8, 2013

Guadalupe River Land For Sale

Unforeseen and unexpected interest and options have arisen which have caused a delay in the offering of tracts for sale. I hope to have these issues resolved relatively soon. I apologize for the delay in offering tracts for sale. Tracts should be identified and priced as soon as possible barring any prior sale.

Parcels of the 70.15 acre tract of land fronting on both US 183 and the Guadalupe River will soon be offered for sale. Check back here for details about property offerings very soon.

This map is the official FEMA flood plain designation. Most of the subject property coming up for sale is outside of the 100 year flood plain.

Live Water Property on the Guadalupe River with a buildable home site is extremely rare to find in South Texas. This property has both home and recreational uses for boating, swimming, fishing, and scenic enjoyment. Owning a live water tract is the ultimate status symbol.

USGS topographic map

FEMA map

Parcels of the 70.15 acre tract of land fronting on both US 183 and the Guadalupe River will soon be offered for sale. Check back here for details about property offerings very soon.

This map is the official FEMA flood plain designation. Most of the subject property coming up for sale is outside of the 100 year flood plain.

Live Water Property on the Guadalupe River with a buildable home site is extremely rare to find in South Texas. This property has both home and recreational uses for boating, swimming, fishing, and scenic enjoyment. Owning a live water tract is the ultimate status symbol.

USGS topographic map

FEMA map

USGS topographic map

The FEMA and USGS topo maps clearly show the vast majority of land in the Steen Plain is either in the floodway or the flood plain. There quite simply is precious little land in the area that is not subject to severe flooding.

Friday, March 1, 2013

ON VACATION

My apologies to those of you who have been wondering what happened to my Eagle Ford blog. Well, long story short, the story is getting a little long in the tooth and so many others are covering what is going on that I have begun to feel a little superfluous chiming in. I'm very proud to have been the first to recognize the true value of the Eagle Ford and I did my level best to let all landowners know what was going to happen. Now I am leased, perhaps the last to do so, and there is far less need for my commentary. I am trying to think how I can re-brand this blog to serve landowners as I have been doing for so long now. I will keep you posted, so check back and see what I have in store. Thanks for all your past support. This blog has received several hundred thousand page views and is ranked highest of all Eagle Ford blogs on Google search. You guys have been listening to what I have been preaching. My hope for each of you is that you attain the success that I have by being armed with the information you need to know.

Wednesday, October 31, 2012

Minerals No Longer Available

Accepting Offers For Surface Use Only

Accepting Offers For Surface Use Only

High-Grade 45-50 degree API Volatile Oil w/88% Liquids

DeWitt County In The Heart Of The Best Acreage

contact owner Mike Green at 361-648-5800 email libertadormg@gmail.com

This property is located on a major highway, US 183, and is directly across the road from the EOG Meyer Unit. Tract has over 1,600 ft of US 183 highway frontage, approximately 1/2 mile Guadalupe River frontage, it is very close to the Enterprise pipeline, and comprises the only substantial acreage in the area that does not flood for approximately a mile in all directions. This land quite simply has multiple superior strategic advantages for developing the Eagle Ford in the Steen Plain area of the Eagle Ford oil and NGL windows. All adjacent tracts are leased to EOG Resources. Notable is the fact that very little land in the immediate area did not flood in 1998 with the notable exception of a good portion of this property. All depths and horizons are available, including the Pearsall.

CONTACT OWNER MIKE GREEN 361 648 5800

High Grade Area

Irregular shape should allow for more lateral's

High Ground elevation in large flood plain. Potential drilling site above historic flood level of 1998

Major highway frontage on US 183

Meyer Unit across highway and Burrow B Unit on property line

Area is being rapidly developed with infill drilling

High ground on US 183

Sunday, October 28, 2012

At DUG Eagle Ford Rosetta Resources Makes Bold Claims

Friday, October 19, 2012

Marathon High-Grading Eagle Ford Acreage

Marathon High-Grading Eagle Ford Acreage

The recent decision by Marathon to sell-off approximately 97,000 acres of their less economic dry gas and marginal black oil window Eagle Ford acreage in order to focus and concentrate on drilling and developing their over pressure volatile oil window acreage is roundly seen by analyst's as a net positive for the company. There has lately been a virtual stampede among operators to sell off non-core assets. Shedding their less economic acreage in favor of holding and fast-track developing their over pressure volatile oil window has become the du jour operator business model to follow of late. This sale will further enhance and validate the wisdom of last year's purchase by Marathon of an approximately 65% working interest in a large swath of EFS acreage from Hilcorp for $25,000 per acre. At the time last year Eagle Ford naysayers and those of little faith of the extreme economics of the play blustered profusely how foolish the $25,000 per acre price paid was. If as expected, Marathon successfully flips this less valuable acreage for the average price it paid last year of $25,000 per acre it will be seen by investors as smart business move.

A chorus of crude oil experts at the DUG Eagle Ford Conference recently joined in singing the praises of the Eagle Ford by proclaiming it's as good or better than anything found in the Middle East. The light sweet volatile oil window is just awesomely economic beyond belief. As operators pivot into oil factory mode and the extreme economics are better understood there will be deals for many, many multiples of the highest prices paid per acre to date. Publicly we know that Aurora Oil & Gas paid over $100,000 per acre for approximately 70% working interest in Sugarkane acreage in Karnes County a few months back. Expect private deals in the future to shatter this once thought lofty price. The show has just begun, Eagle Ford is the wonder of the oil industry today.

Tuesday, September 18, 2012

Valuing Eagle Ford Acreage

Valuing Eagle Ford Oil and Gas Assets

What is the value of the oil under your land in the Eagle Ford? It turns out that it’s not that difficult to learn the answer to that question by doing a little online research and putting that knowledge to work. With the enormous values being paid today between operators for undeveloped acreage in the Eagle Ford it’s the duty of us landowners to understand what we own. To do otherwise is dereliction. I see it as our sacred duty to protect our families by making them aware and passing on important information regarding the value of our land. Whether leased or not, you can get a better understanding of what you own by starting with the articles I have hyperlinked below.

Valuing Oil and Gas Assets In The Courtroom

VALUING PUD RESERVES: A PRACTICAL APPLICATION OF REAL OPTION TECHNIQUES

Try to become familiar with the different types of oil and gas assets by learning the following key definitions.

Prospect. A specific geographic area which, based on supporting geological, geophysical or other data and also preliminary economic analysis using reasonably anticipated prices and costs, is deemed to have potential for the discovery of commercial hydrocarbons.

Proved developed reserves (PDP). Reserves that can be expected to be recovered through existing wells with existing equipment and operating methods.

Proved reserves. The estimated quantities of oil, natural gas and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions.

Proved undeveloped reserves. (PUD). Reserves that are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion.

Wednesday, August 29, 2012

Guadalupe-Blanco River Trust

By granting a bequest of a conservation easement to Guadalupr-Blanco River Trust landowners can ensure that their property will be managed according to their wishes well beyond his or her lifetime. A conservation easement permanently limits a property's uses in order to limit development and ensure that the property is reserved for farming, grazing land, wildlife habitat or cultural values. Landowners can stipulate no oil and gas development. Tax incentives may be available to landowners. It's worth giving a serious thought.

Friday, August 24, 2012

DUG Eagle Ford

Last year I had the incredible good fortune to attend the DUG Eagle Ford conference in San Antonio and I heartily endorse, recommend and encourage all landowners who can to attend the conference this year. The direct benefits you will receive is a crash course education about what is going on in the Eagle Ford and Pearsall Shale. The speakers are highly regarded industry leaders that give you not only a review of where we are in the play but also an idea where Eagle Ford is heading. The exhibitor hall is immense, representing virtually all aspects of drilling and production technology and you get the opportunity to visit with them. The $895 investment you make to attend is a very small price to pay for the Eagle Ford education you will receive. If you own a Eagle Ford mineral interest you own something worth millions of dollars and you owe it to yourself and your family to attend DUG Eagle Ford.

Thousands have already registered;

Shouldn't your team get the same advantage?

Don't miss the world's biggest Eagle Ford conference Petroleum producers, midstream operators, finance and service professionals are converging in San Antonio this October for the 4th annual DUG Eagle Ford conference and exhibition. Shouldn’t you and your team be there to share the intelligence and make new business connections?An unparalleled slate of industry leaders is presenting and nearly 350 exhibitors are displaying their technologies. The biggest players on the scene, both upstream and midstream, will be attending. Once again, this event is the world’s largest Eagle Ford conference for the same reasons: It's the single best place to learn "what's next" for one of the most exciting regions in today's oil & gas business.

Featured speakers include: View full speaker line-up

EVP and COO Marathon Oil Corp. | President and COO Pioneer Natural Resources | President Swift Energy |

Speakers in the midstream program track — new for 2012 — will detail their plans for adding takeaway and treatment capacity. And one registration gives you access to both program tracks. Together, you get a full-spectrum perspective on where the opportunities lie ahead.

Go online to check the agenda and register today. Interested in bringing your entire team? Register 4 or more and receive $100 off each registration – just click the link when you register online.

Thursday, August 23, 2012

Drilling For Oil In The Unconventional Eagle Ford Shale

Drilling for crude oil in the

unconventional Eagle Ford shale is very much still in it's infancy. We are in the very early innings. The Eagle Ford has been know to be the

source for conventional natural gas and crude oil reserves in the

area for decades. Technology is improving at a very rapid pace and

horizontal drilling techniques continue to improve exponentially. Down spacing is occurring at 40 acres per well. EURs are going up substantially. Operators have rushed in to lease the best acreage in the six largest

shale basins that comprise 57 million acres. It's going to take a

very, very long time to develop all that acreage, perhaps a century

experts are saying.

Success in drilling in the Barnett,

Haynesville and Marcellus has caused the gas market to collapse.

Operators all want to drill on good oil prospects today like the

Eagle Ford volatile oil window. The oil window is where all the

action is today and that's where operators are allocating all of

their capital.

Little noticed in all that is going on

in the Eagle Ford is the way that it is shaping the future for the

petrochemical industry. Many large refineries and chemical plants are

being planned and announced for the Texas Gulf Coast. Pipelines are going in everywhere

along the entire length of the Eagle Ford. More pipelines are being

announced monthly.

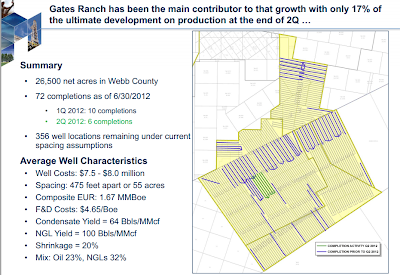

The long and short of the Eagle Ford is that all liquids window acreage is extremely valuable. Mineral interest to all depths and horizons is incredibly valuable. Rosetta Resources claims EURs of 1.67 Million BOE per well at 55 acre spacing. At $100 oil the 1.67 million BOE per

well translates to $167,000,000 per 55 acres. If you owned 55 acres

and you receive 25% royalty that would amount to $41,750,000 due you

over the life of the well. With other horizons like the Austin Chalk,

Pearsall, Olmos and Buda you quickly see why Eagle Ford footprint

acreage is selling for well over $100,000 per acre.

Subscribe to:

Comments (Atom)

.jpg)